How Are ETFs Created?

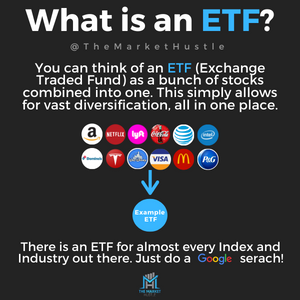

What is an ETF (exchange-traded funds)?

ETFs (exchange-traded funds) are similar to mutual funds.

You can think of an ETF as a basket of stocks. When you buy part of the basket, you own part of the stocks in the basket.

ETFs trade on the stock market just like a regular stock.

There are several different types of ETFs.

Some ETFs track specific indexes (such as the S&P 500 index).

While other ETFs offer more complex strategies using derivatives.

Looking under the hood of how ETFs are created can get complex.

So I’m going to summarize the steps ETFs generally go through before becoming investible to investors like you.

How are ETFs created?

Step 1: ETFs are started by an ETF manager (known as a sponsor). The ETF manager then files a plan with the SEC to create an ETF.

Step 2: The ETF manager forms an agreement with what’s called an “Authorized Participant.” This authorized participant (usually a market maker, investment bank, or some large investment institution) will act as the liquidity for the fund. They have the right to create and redeem ETF shares to maintain a proper balance within the fund based on investor demand.

That way, the fund's price will closely resemble the underlying asset price changes (more on that later).

Step 3: The authorized participant acquires bundles of stocks in their appropriate weightings, typically done in bundles for 50,000 shares. The authorized participant then delivers those blocks of shares to the sponsor.

Step 4: ETF shares are then created to represent the bundles of stocks and sold on the public stock market. ETF shares are legal claims on the share bundles (also known as creation units) held in the fund.

Step 5: When ETF demand increases, more ETF shares can be created by adding more bundles of stocks. When demand decreases, bundles of stocks can be sold off (or redeemed), and ETF shares can effectively be destroyed.

How are ETFs Redeemed? (Expanding On The Redemption Process)

Investors who want to sell their ETF can do so on the public market. This is the most popular way to sell an ETF share.

Authorized Participants (or other large institutions) can also gather enough ETF shares and then exchange them for the blocks of shares. When these investors redeem their ETF shares, the block is destroyed, and the stocks are turned over to the redeemer.

ETF Market Price VS ETF Net Asset Value (NAV)

The ETF market price is the price at which shares in the ETF can be bought or sold on the stock market.

The net asset value (NAV) of an ETF portrays the value of each ETF share’s portion of the fund’s underlying assets.

The Math: The NAV of an ETF is calculated by taking the sum of the assets in the fund, including any securities and cash, subtracting out any liabilities, and dividing that figure by the number of ETF shares outstanding.

Due to changes in the supply or demand for an ETF at any single point in time, the market price of an ETF may shift from the underlying asset value from time to time.

For each ETF, the authorized participants are assigned to ensure that, over time, the share's price reflects the NAV's price.

When the share price becomes much lower than the NAV, market makers typically intervene and buy shares to increase their prices. When the price is too high compared to the NAV, market makers sell shares to lower the price.

The NAV is typically used to compare the performance of funds.

Below you will see the NAV and Market Price comparison for VOO. There has been practically no difference between the NAV and Market Price since its inception.

Where can I find the NAV of a fund?

You can generally find the NAV of each fund on ETF.com by searching up the fund or by looking at the fund’s prospectus.

Also, sign up for my email list to be the first to know when I publish a new blog post!

Want to keep learning? Check out some of my other blog posts:

As Always: Buy things that pay you to own them.

-Josh

Blog Post: #030