How To Buy Stocks During A Recession For Dummies (AKA: How To NOT Lose Money)

It's no secret that the stock market can be a roller coaster ride, especially during times of recession. For new investors, it can be daunting trying to figure out how to buy stocks during a recession.

Every day, people from all walks of life log onto their brokerage accounts and buy stocks to make their future selves richer. Some people are very successful at it. Others, not so much.

If you're new to the game and are looking to get started, here's a quick guide on how you can get started.

5 Steps To Buy Stocks During A Recession:

Step 1: Find a brokerage

Step 2: Determine what type of account to open

Step 3: Determine what stocks (or funds) to buy

Step 4: Automate your investments

Step 5: Keep the long-term vision

Step 1: Find a broker

The first thing you need to do is find a broker. A broker buys and sells stocks on behalf of their clients. There are many different stock brokers out there, so it's essential to do your research to find one that best suits your needs.

Once you've found a broker you like, the next step is to open up an account with them. This usually requires some paperwork and money to get started. It’s very similar to opening up a bank account.

Some of the things I look for in a good broker include:

Fractional Share Investing

Zero-Fee Trades

Good Customer Service

Easy To Use Platform

You can read more about my favorite stock brokers here.

Step 2: Determine What Type Of Account To Open

Regarding investment accounts, there are a few options to choose from...

If you're looking to invest for your retirement and want to save on taxes, you may want to consider opening a Roth IRA account.

Roth IRA accounts offer tax-free growth on your investments, meaning you won't owe any taxes on your gains when you eventually withdraw the money at retirement age.

Roth IRA accounts also restrict how and when you can withdraw your money, so be sure to read up on the rules before opening an account.

Opening a standard brokerage account might be ideal if you only want to invest for the next 5-10 years. Standard accounts are the most common and flexible account types. But they don’t offer any special tax advantages as retirement accounts do.

Here are some popular investing accounts to consider:

Standard Accounts (Taxable)

Roth IRA (Retirement account)

Traditional IRA (Retirement account)

401(k) (Retirement account)

Custodial Account (Investing For Kids)

Step 3: Determine What Stocks (or funds) To Buy

Now that you have an account with a broker, it's time to start buying stocks!

The most important thing to remember when buying stocks is that you're investing in a company, not just gambling on whether or not the stock price will go up or down. Do your research on the company before investing any money.

Once you've found a company you're interested in, you can log on to your brokerage account, search for the stock or fund you want to buy, and submit a buy order to purchase stocks on the open market.

Your stock order won’t officially execute until the stock market is open. The stock market is open Monday through Friday from 9:30 a.m. to 4 p.m. (EST). The stock market is closed on most holidays. If you submit an order when the stock market is closed, It won’t officially execute until it opens.

Once you own shares of stock in a company, you become a partial owner of that company. That means that if the company does well, the value of your shares will go up, and you can make money by selling them at a higher price than what you paid. On the other hand, if the company doesn't do well, the value of your shares will go down, and you could lose money.

You can learn more about how to research individual companies here.

Does the idea of trying to pick individual stocks utterly terrify you?

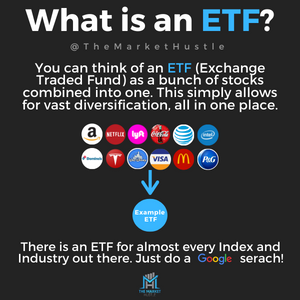

It’s never been easier to build a long-term “set it and forget it” portfolio, thanks to ETFs. ETFs have made it easier for anyone to invest passively in the stock market without worrying about picking the right stocks.

What are ETFs? You can think of ETFs as a bunch of stocks combined into one stock, as seen in the picture below…

You can read more about ETFs here.

Step 4: Set Up Auto Invest

It’s 2022. Automating your investment purchases is the best way to stay consistent with investing. Almost every stock brokerage offers automatic investment contributions.

By automatically contributing a fixed amount of money from your paycheck to your investment account, you can ensure that your money is working hard for you.

Automatic investment contributions can also help to increase your investment returns over time. This is because the sooner you start investing, the longer you have for your investments to grow.

Your million-dollar stock portfolio starts with buying stocks consistently every time you get paid.

One of the best habits you can develop is investing consistently.

Step 5: Keep the long-term vision

When investing in stocks, keeping the long-term vision in mind is essential.

Many people lose money in the stock market because they think in 5-day terms, not 5-year terms. Short-term thinking can lead to making decisions based on emotion rather than logic.

It is important to remember that the stock market is a long-term game. Over the long run, the stock market has always gone up. There have been periods when the market dropped, but it has always recovered and reached new highs. Therefore, it is important to stay invested for the long term. This way, you will be more likely to weather the ups and downs of the market and ultimately come out ahead.

As long as businesses continue to grow and innovate, so will the stock market.

Stock Market Chart: Dow Jones Stock Market Returns Since 1789

Final Thoughts: How To Buy Stock For Dummies

Investing is easy. Staying invested is hard. This can be difficult, as markets constantly fluctuate, and it can be tempting to cash out when prices are down.

However, the best way to make money in the stock market is to buy good stocks or funds and hold onto them for years, even during periods of decline. Of course, this requires a lot of patience and discipline, but it is worth it in the end. After all, the big money is made in the holding.

Unless you are a few years away from retirement: Any drop in the stock market should be seen as a gift.

Also, sign up for my email list to be the first to know when I publish a new blog post!

Want to keep learning? Check out some of my other blog posts:

As Always: Buy things that pay you to own them.

-Josh

Blog Post: #052