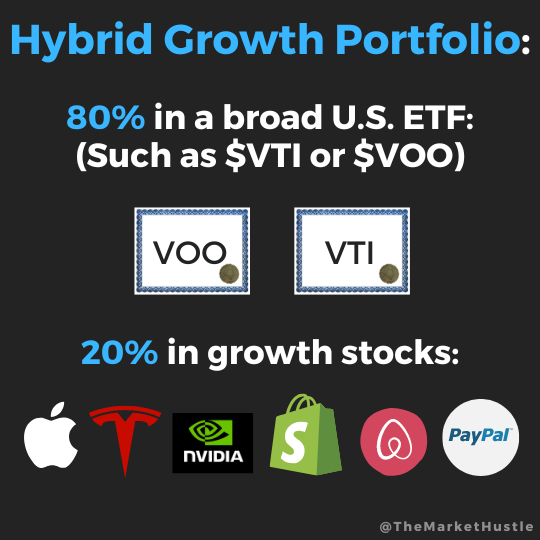

Hybrid Growth Portfolio (80/20)

What is the Hybrid Growth Portfolio?

The Hybrid Growth Portfolio is an investment strategy for investors who want to develop a strong core portfolio but also sprinkle in some aggressive growth.

The Hybrid Growth Portfolio involves investing 80% of your portfolio in broad U.S. ETFs (such as $VOO or $VTI) and 20% of your portfolio in individual growth stocks.

Keep in mind that this portfolio strategy is considered aggressive and is not meant for every investor.

80% Broad U.S. ETFs

Investing 80% of your portfolio in broad U.S. ETFs gives you significant exposure to the average growth the U.S. stock market has historically offered.

The U.S. stock market has returned an average of 10% per year over the last century. This gives your portfolio a great foundation to rely on for long-term growth.

Legendary investor Warren Buffett has repeatedly recommended that most investors buy S&P 500 index funds, stating that they would likely outperform most professional investors doing so.

What are ETFs?

ETF stands for Exchange Traded Fund. You can think of ETFs as a bunch of stocks combined into one stock. ETFs make it possible to invest in stock indexes such as the S&P 500. ETF fund managers set up a system to buy stocks in proportion to how much the stocks make up the specific index they’re tracking.

Broad U.S. ETF Examples:

VOO (S&P 500 Fund)

VTI (Total U.S. Stock Market Fund)

20% Growth Stocks

Investing 20% of your portfolio in growth stocks allows those who want to take an active investing approach to do so, but not at the expense of being completely wiped out.

Although most investors never beat the market average, this hybrid portfolio allows you to test your stock-picking skills without risking a complete portfolio blow-up.

What is a growth stock?

A growth stock is a company that is expected to grow its revenue and profits faster than average. These are generally newer companies with much higher risk and growth potential.

Investing in growth stocks that are already in your ETFs

Since many large growth stocks are already included in broad U.S. ETFs, you might run into a scenario where you are interested in adding a growth stock that you already have some exposure to.

Adding it to your 20% growth stock portion can still make sense. Specifically, if you want additional exposure to that company.

For example, Apple makes up a large portion of VOO and VTI. If you wanted additional concentrated exposure to Apple, you could add the stock to your 20% growth stock portion.

How much of each specific stock you add depends on how much exposure you want to each particular company.

Growth Stock Examples:

Apple ($AAPL)

Alphabet ($GOOG)

Airbnb ($ABNB)

Spotify ($SPOT)

Hybrid Growth Portfolio Pros

Gives investors the ability to test their stock picking skills and potentially get higher than average returns.

Builds a strong core portfolio made up of time-tested ETFs.

Incentivizes you to continue learning about the stock market and researching companies.

Hybrid Growth Portfolio Cons

Could stunt your optimal portfolio growth if you add the wrong individual stocks.

Requires more of your time to manage your portfolio.

Not ideal for those who can’t stomach the additional volatility that generally comes with investing in individual stocks.

Final Thoughts: Hybrid Growth Portfolio

The Hybrid Growth Portfolio allows investors to test their stock picking skills without taking on too much risk. If you add the right growth stocks to your portfolio, you could potentially outperform the stock market average return.

This portfolio strategy could be great for those with a long investment time horizon who enjoy researching companies and paying attention to the stock market.

However, if you are the type of investor that likes to take a hands-off investing approach, this portfolio strategy wouldn’t be a great fit for you.

Also, sign up for my email list to be the first to know when I publish a new blog post!

Want to keep learning? Check out some of my other blog posts:

As Always: Buy things that pay you to own them.

-Josh

Blog Post: #044