Pros and Cons of ETFs: Your Ultimate Guide

There are many ways to invest in the stock market, like stocks and ETFs, so investors can quickly get confused if they don’t understand the pros and cons of each of them.

What is an Exchange Traded Fund (ETF)?

An ETF is an investment vehicle that provides investors exposure to a basket of companies on the stock market.

ETFs trade on the stock market like any other stock, and their prices fluctuate during the trading day.

On the other hand, mutual funds only trade at the closing price of each day and are not actively tradeable.

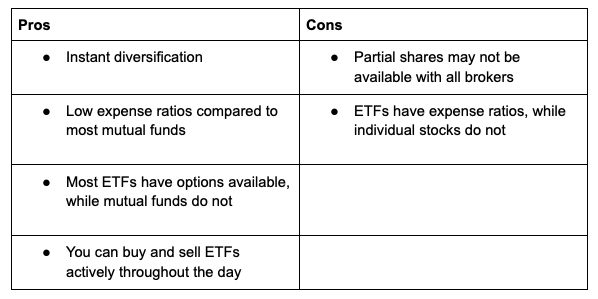

Pros and Cons of ETFs

Pros of ETFs

There are many reasons to invest in ETFs as they offer retail investors a cost-effective way to get exposure to the stock market.

Instant Diversification

ETFs give investors exposure to a basket of companies on the stock market.

Therefore, ETF investors don’t need to analyze specific companies and choose the best ones since the fund manager takes care of the stock picking.

Low Expense Ratios

Compared to actively managed mutual funds, ETFs that track an index come with low fees.

Picking ETFs with the lowest expense ratios is an excellent way to increase returns since you won’t pay nearly as much in fees.

Optionable

Mutual funds are not actively tradeable and are not optionable, which means you can’t utilize strategies like the covered call to hedge your portfolio.

Even if you are not planning to trade options, it is always nice to have the ability to if you ever change your mind.

Actively Tradeable

ETFs are much more liquid than mutual funds, so you can buy and sell them throughout the day as the price fluctuates.

Mutual funds only change the price once per day when the market closes, so if the market trades at a better price during the trading day, you will miss out on mutual funds.

Cons of ETFs

There are various pros for ETFs, but you must also understand the downsides of them to ensure they are the best investment for you.

Partial Shares May Not be Available

Mutual funds allow you to purchase shares with any amount of money, regardless of the price per share.

With ETFs, you must buy exact shares, meaning if one share costs $300, you must buy in $300 increments.

However, if you use a stock brokerage that offers partial shares, you can buy ETFs with any amount of money.

ETFs Have Fees, While Stocks Don’t

When you buy ETFs, you must pay the expense ratio to the fund manager for managing the stock allocations.

If you replicate the ETFs holdings, you can avoid the fees, but this requires more management and tax if you realize gains when rebalancing.

Investment Alternatives to ETFs

ETFs are excellent investments, but there are many other choices available to investors.

Individual stocks

If you want to avoid fees, you can pick out your favorite stocks from the ETFs you would invest in.

For example, if the ETF you are looking at includes Apple and Microsoft as the top holdings, you can buy these stocks instead of the ETF.

Mutual funds

Mutual funds are similar to ETFs, except they only have their price updated once per day.

If your broker offers fractional shares, there’s not much of a reason to invest in mutual funds over ETFs.

Individual bonds

Bond ETFs exist, but they are not risk-free like individual bonds are.

When you buy an individual bond from the government, you are guaranteed to be paid back, given the U.S. government doesn’t go under.

Types of ETFs

There are thousands of ETFs available on the stock market. Most of them are nearly duplicates and invest in the same assets but are managed by different companies.

When searching for an ETF for your portfolio, you must research the top holdings and expense ratios to ensure you get the best deal.

Equity ETFs

Equity ETFs are the most common and invest in all kinds of companies, including international and domestic, depending on the ETF's goals.

Sector ETFs

Sectors ETFs can give investors exposure to specific sectors and industries in the stock market. For example, you can invest in tech ETFs to take advantage of the best tech companies.

Bond ETFs

Bond ETFs allow you to invest in bonds without picking specific bonds on your own. However, bond ETFs are not risk-free investments like buying individual bonds.

Pros and Cons of ETFs | Bottom Line

ETFs are a fantastic investment vehicle and provide retail investors with an efficient way to invest in stocks.

They provide instant diversification into the overall market or specific sectors with reasonable expense ratios.

Additionally, most are optionable, which allows you to hedge your portfolio with puts and generate income with a covered call strategy.

However, ETFs come with fees, while investing in individual companies does not.

If you are an avid investor who likes to manage their allocations, you can replicate an ETF by buying the same stocks in the fund.

There can be hundreds of stocks in each fund, though, so it is not an easy task to replicate one, making the expense ratios worth it for most investors.

Also, sign up for my email list to be the first to know when I publish a new blog post!

Want to keep learning? Check out some of my other blog posts:

As Always: Buy things that pay you to own them.

-Josh

Blog Post: #071