QQQ vs VGT - Which ETF Is Better?

In the world of investing, you may have heard about QQQ and VGT, two of the big names when it comes to tech-focused ETFs. While they may seem similar at a glance, each has its own unique strengths and weaknesses. If you're wondering which one might be better for you, stick around!

We're going to dive into each of these funds, looking at what they offer, their benefits, and their downsides.

QQQ - Invesco QQQ Trust

Goal: The goal of QQQ is to replicate the performance of the NASDAQ-100 Index. It aims to provide a broad exposure to large, innovative companies, specifically within the technology sector.

Number of Stocks held: 101

Dividend Yield: 0.57%

Annual Expense Fee: 0.20%

Benefits of QQQ: QQQ offers broad exposure to large, innovative companies, many of which are leaders in their respective industries. This ETF provides a great way to invest in the tech sector without having to pick individual stocks. Moreover, QQQ's strong track record demonstrates its ability to consistently deliver solid returns.

Downsides of QQQ: Although QQQ has many benefits, it's heavily weighted towards the technology sector, which can make it more volatile during market downturns. Also, its dividend yield is on the lower side compared to other ETFs, so it might not be the best choice for dividend-focused investors.

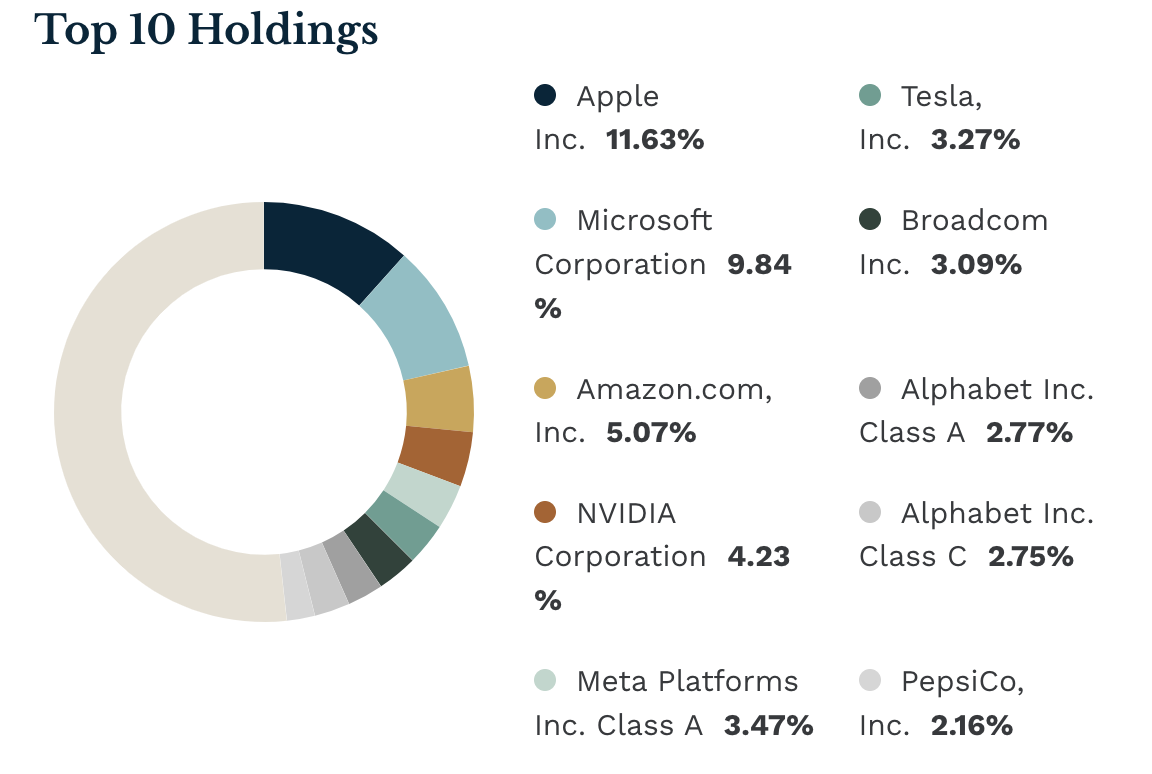

The Top 10 Stocks Held In $QQQ:

Source: ETF.com

VGT - Vanguard Technology ETF

Goal: VGT seeks to track the performance of a benchmark index that measures the investment return of stocks in the technology sector.

Number of Stocks held: 322

Dividend Yield: 0.67%

Annual Expense Fee: 0.10%

Benefits of VGT: VGT provides wide exposure to the technology sector, including both large and mid-sized companies. It is managed by Vanguard, which is renowned for its low-cost funds. With a slightly lower expense ratio than QQQ, it can be an attractive option for cost-conscious investors. VGT is also more diversified than QQQ.

Downsides of VGT: While VGT does offer a diverse range of tech stocks, it has a narrower focus in the technology sector, which can lead to higher volatility. Also, being sector-specific means that it lacks the diversification across different sectors that some investors may want.

The Top 10 Stocks Held In $VGT:

Source: ETF.com

Final Thoughts: QQQ vs VGT

Both QQQ and VGT offer compelling opportunities for those looking to invest in the technology sector. They are similar in many ways, but there are key differences that can help you decide which one may be a better fit for your portfolio.

QQQ, focused on the NASDAQ-100 Index, offers broad exposure to innovative companies and has a strong historical performance. However, it may not be the best for income-focused investors due to its lower dividend yield. On the other hand, VGT, with its focus on the technology sector, offers a higher dividend yield and a lower expense ratio, which may be attractive to cost-conscious investors.

While VGT has a longer track record, QQQ is a larger fund with more assets under management. When comparing their 10-year performance, VGT had an annual performance of 20.68%, whereas QQQ had 18.66%.

In the end, the right choice between QQQ and VGT depends on your individual goals, risk tolerance, and investment strategy. If you are more dividend-focused and want a broad range of stocks within the tech industry, VGT might be more suitable.

But if you are looking for broader exposure to innovative companies and don't mind a slightly higher expense ratio, QQQ could be your ticket.

By the way: Sign up for my email list to be the first to know when I publish a new blog post!

I recently put together a master list of 88 different ETFs designed to support different investment goals. You can grab it here.

As Always: Buy things that pay you to own them.

-Josh

Blog Post: #132