The Best Recession Defensive ETFs To Protect Your Portfolio

Stock market crashes are never fun to deal with. Especially if you aren’t prepared. When the stock market hits a rough patch, you must have a plan to manage your portfolio risk. Long-term investors generally should not sell their funds to avoid mistiming the market and creating a taxable event.

In volatile market conditions, growth stocks tend to get hurt the most, while defensive stocks might even thrive. So if you want to keep investing but aren’t confident in growth stocks, recession defensive ETFs might be an excellent choice for you.

What is a Recession Defensive ETF?

Defensive ETFs hold companies that tend to ride out recession better than most. This includes profitable blue-chip stocks that have proven themselves during turbulent times.

While these defensive ETFs may still decline during recessions and volatile markets, they usually don’t get hit as hard compared to the S&P 500 index and risky growth stocks.

Examples of recession defensive stocks include companies like Coca-Cola, Walmart, and Procter & Gamble. Regardless of economic conditions, consumers will still need to buy everyday items like food, toothpaste, and soap.

The Best Recession Defensive ETFs

$DVY iShares Select Dividend ETF

10 year average return: 11.39%

Expense ratio: 0.38%

Dividend yield: 3.57%

Number of stocks held: 99

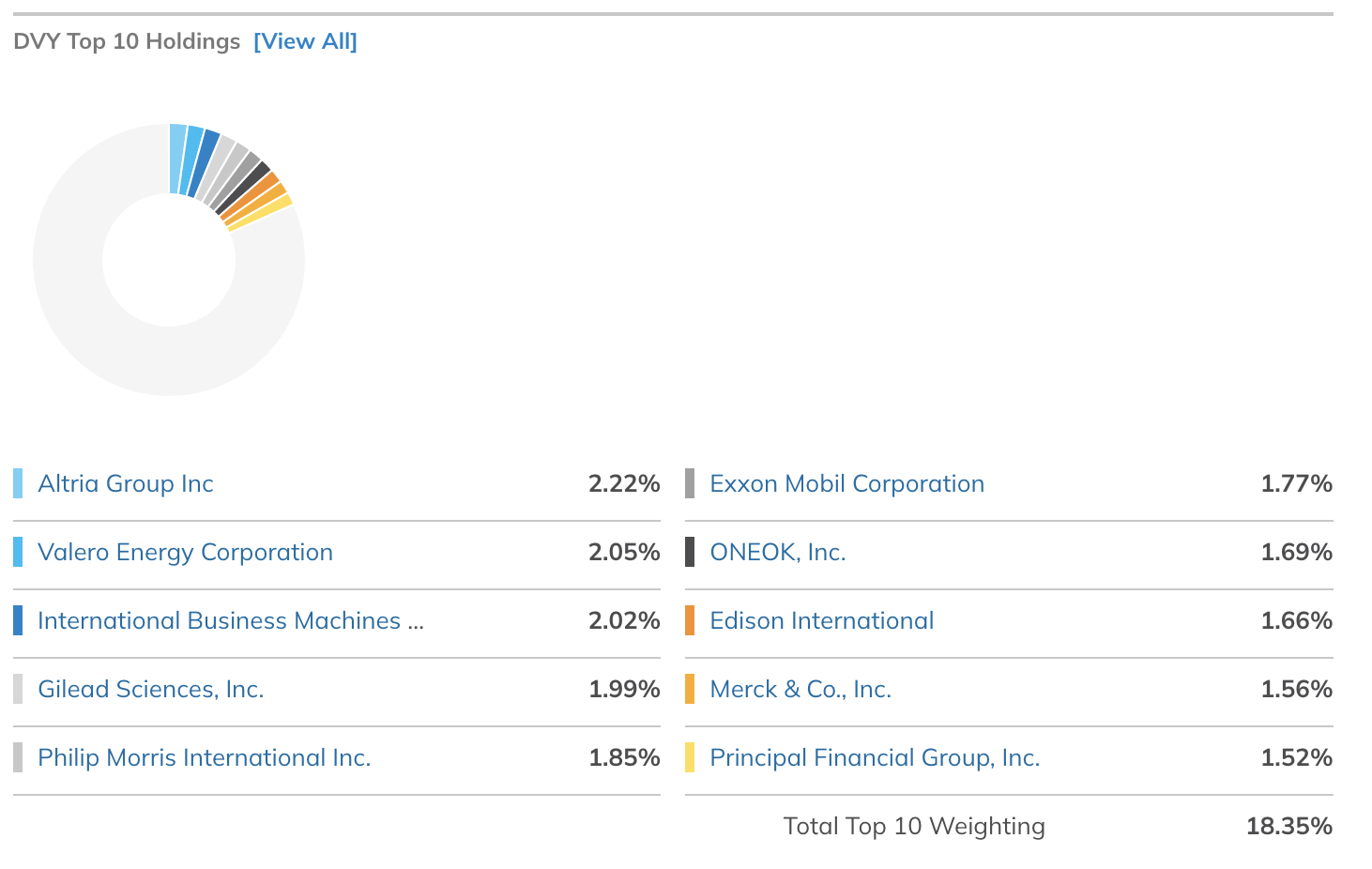

This dividend ETF seeks to track the returns of an index of high dividend-paying U.S. companies. Investing in this defensive ETF will expose you to 100 different income-generating companies.

Most stocks that pay consistent dividends generate constant cash flow and are less affected by volatile market conditions. So if you want to invest in a basket of stable dividend-paying companies, $DVY could be a solid investment choice.

Top 10 stocks held within $DVY:

Image source: ETF.com

$VIG Vanguard Dividend Appreciation Fund

10 year average return: 11.89%

Expense ratio: 0.06%

Dividend yield: 1.89%

Number of stocks held: 289

The Vanguard Dividend Appreciation ETF tracks an index of stocks that increase dividend payments over time. Generally, stocks that increase their dividend payments over time generate consistent revenue and profits, making them a great defensive play.

The greatest investors, such as Warren Buffett, utilize a dividend growth strategy when choosing stocks to buy. The longer you hold the stock, the higher your yield will be since the stock price will typically appreciate, and the dividend payment will increase as well.

Top 10 stocks held within $VIG:

Image source: ETF.com

$SPLV Invesco S&P 500 Low Volatility ETF

10 year average return: 10.42%

Expense ratio: 0.25%

Dividend yield: 2.00%

Number of stocks held: 101

This defensive ETF tracks an index of the 100 least volatile companies in the S&P 500 as determined by the index provider. If you are looking for an ETF that pays dividend income and does not move much compared to the average stock, the Invesco S&P 500 low volatility ETF is an excellent choice.

Compared to a Vanguard fund, the expense ratio is a bit high, which is one of the downsides of this ETF. However, each ETF is managed differently, so the deciding factor should depend on its holdings and your investment preferences.

Top 10 stocks held within $SPLV:

Image source: ETF.com

$SPHD Invesco S&P 500 High Dividend Low Volatility ETF

5 year average return: 6.50%

Expense ratio: 0.30%

Dividend yield: 3.78%

Number of stocks held: 50

This Invesco ETF seeks to track the returns of the 50 least volatile and high dividend-paying companies in the S&P 500. The Invesco S&P 500 high dividend low volatility ETF is an excellent choice if you want an ETF that automatically invests in the highest-yielding companies in the S&P 500.

However, high yield does not equate to a quality company. Therefore, before investing in any ETF, you should analyze its holdings and make sure you have conviction in them.

Unfortunately, some companies on the stock market are yield traps or companies that pay a high dividend to trap investors into thinking it is a good company.

Top 10 stocks held within $SPHD:

Image source: ETF.com

$VYM Vanguard High Dividend Yield Index Fund

10 year average return: 10.16%

Expense ratio: 0.06%

Dividend yield: 3.08%

Number of stocks held: 444

The Vanguard high dividend yield index fund seeks to track the returns of companies that pay a higher than average dividend yield. Vanguard provides some of the lowest expense ETFs available, making it a popular choice for all types of investors.

Diversified consumer defensive ETFs come with risk, even if it is less than growth companies. Therefore, you must be sure that the fund’s holdings match your investment goals. Nevertheless, if you want to diversify into dividend companies without researching individual stocks, this Vanguard ETF is an excellent choice.

Top 10 stocks held within $VYM:

Image source: ETF.com

$VGSH Vanguard Short-Term Treasury Index Fund

10 year average return: 0.64%

Expense ratio: 0.04%

Dividend yield: 3.65%

The asset with the least risk in the world is short-term U.S. treasuries. The downside to investing in Bond ETFs is that they are not risk-free like purchasing the actual bond.

However, bond ETFs are more liquid than bonds since you can sell them anytime. Therefore, to generate a risk-free return from bonds, you must hold them until maturity.

Defensive ETFs: Bottom Line

When the stock market is more volatile than usual, consumer defensive stocks are a safer place to invest your money. These defensive ETFs will generate a dividend while decreasing in value less than growth ETFs.

While the stock market always comes with risk, defensive ETFs are an excellent way to minimize your portfolio drawdowns during volatile times.

The only downside to investing in defensive stocks is that you will make less when the next bull market inevitably comes around.

However, if you want to maximize your returns, you can attempt to rebalance your portfolio into riskier stocks when you believe the market has made a bottom.

Also, sign up for my email list to be the first to know when I publish a new blog post!

Want to keep learning? Check out some of my other blog posts:

As Always: Buy things that pay you to own them.

-Josh

Blog Post: #054