The Cost of Making Minimum Credit Card Payments

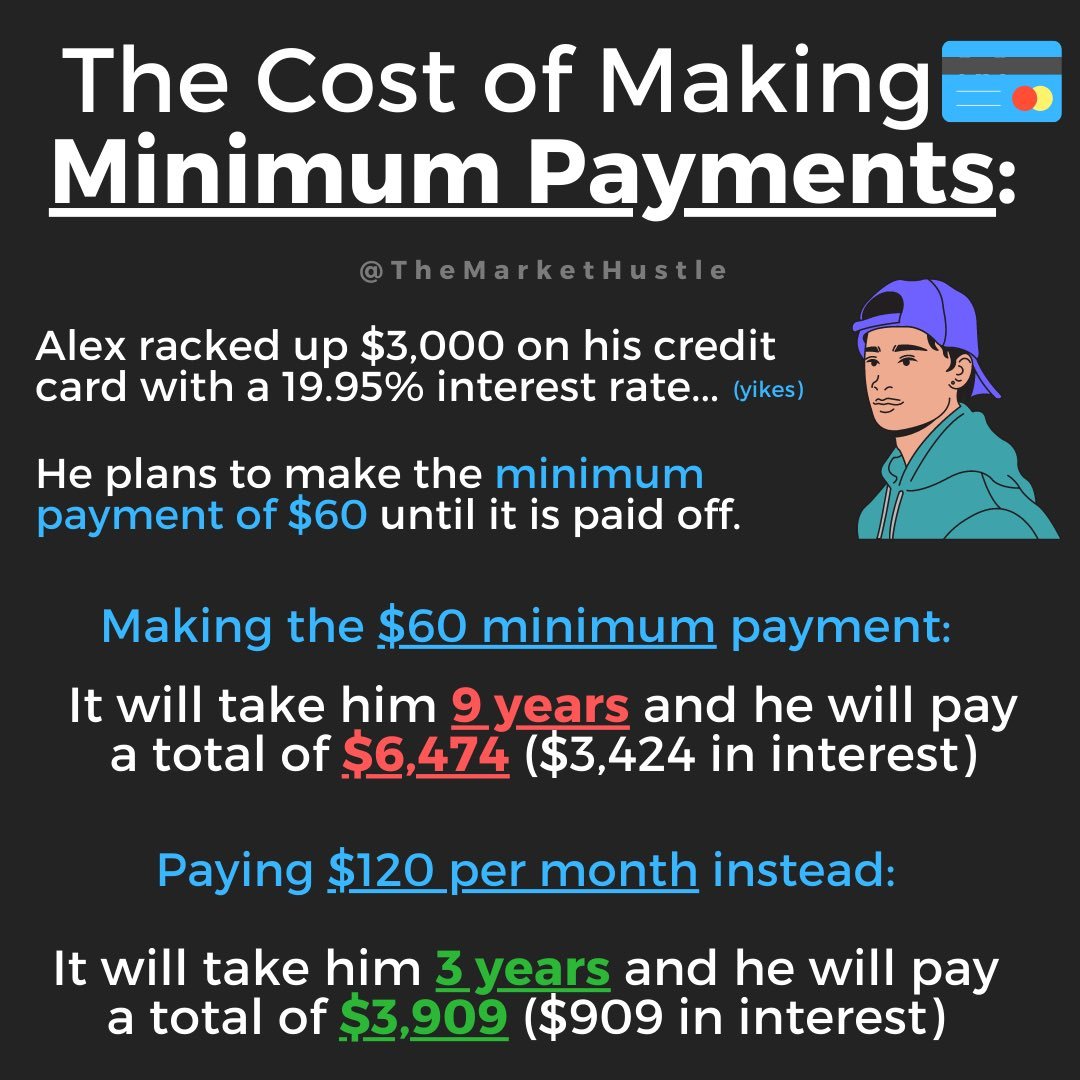

One of the greatest financial mistakes that can cost you a huge amount of money is making only minimum credit card payments.

It's a seemingly harmless decision that can have far-reaching implications on personal wealth building, leaving people stuck in a cycle of debt for years.

This cycle is carefully designed by credit card companies to maximize their profit from interest charges while keeping you tethered to them.

Understanding Minimum Payments and Their Hidden Dangers

A minimum payment on a credit card is the least amount a consumer must pay on their outstanding balance to avoid late penalties. While this may initially appear as a nice option for those strapped for cash, it could lead to a financial disaster of high-interest debt.

The illusion of comfort provided by minimum payments disguises a predatory mechanism. The credit card issuers set a low enough bar to make it convenient for you to service your debt. In reality, this strategy ensures that a substantial portion of your balance continues to build interest. The longer the debt remains, the more money the credit card issuer makes.

It's important to realize that credit card interest rates are among the highest in the financial market, with average rates often falling between 15% and 25%. If you're only paying the minimum, a significant portion of your payment goes toward the interest, barely making a dent in your principal balance. This leads to holding debt longer and larger interest payments over time.

The Power of Compound Interest: Friend or Foe?

Compound interest is a powerful financial concept, but its impact can be a double-edged sword, depending on which side of the equation you're on. Albert Einstein reportedly called it the "eighth wonder of the world," saying, "He who understands it, earns it; he who doesn't, pays it."

In the case of high-interest credit card debt, compound interest is working against you. When you carry a balance on your credit card, the interest is compounded daily, meaning you pay interest on both your original balance and previously accrued interest daily. This can cause your debt to grow exponentially if you're only making minimum payments.

On the flip side, compound interest can be a powerful friend when investing. By reinvesting your investment earnings, you can earn interest on your interest, leading to accelerated wealth growth over time. This is particularly true for stock investments, which historically have offered higher average returns over the long term compared to other asset classes.

How to Break Free and Make Compound Interest Work For You

The key to escaping the minimum payment trap and getting compound interest to work in your favor is by strategically managing your finances. Here's how:

Pay More Than The Minimum: Whenever possible, aim to pay your full balance each month. If that's not possible, pay as much as you can above the minimum payment to reduce your interest charges and shorten your debt payoff timeline.

Prioritize High-Interest Debt: Utilize a debt payoff strategy such as the debt avalanche method, where you pay off your debts starting with the highest interest rate. This strategy minimizes the amount of interest you'll pay over time.

Avoid Credit Card Debt: Prevention is the best cure. Make a habit of not spending more than you are making. When used properly, credit cards can be a tool for managing cash flow and earning rewards, not a gateway to building debt. Strive to pay off your balances in full each month to avoid interest charges altogether. Remember, if you can't afford to pay for something in cash, you can't afford to charge it to your credit card.

Invest Consistently: Once your high-interest debt is under control, prioritize investing to let compound interest work in your favor. Regular, consistent investments to a well-diversified stock portfolio can result in serious wealth growth over time.

Final Thoughts: The Cost of Making Minimum Credit Card

While minimum payments on credit cards may seem harmless or even helpful at first glance, they can be a gateway to a cycle of debt that's difficult to escape from.

By understanding the dangers of minimum payments, the insidious nature of compounding interest in debt, and the potential benefits of making compound interest work for you, it's possible to escape the debt trap and journey towards financial freedom.

In essence, while minimum credit card payments are designed to keep consumers in debt, investing in assets like stocks can leverage the power of compounding to help build wealth. It's crucial to navigate this dichotomy wisely to achieve financial stability and long-term prosperity. By taking decisive steps to pay off high-interest debts and make compound interest your friend rather than your enemy, you can turn your financial life around.

It's important to remember that financial freedom isn't achieved overnight, and it requires a commitment to making smart financial decisions consistently. But with knowledge, patience, and discipline, anyone can transition from a cycle of debt to a cycle of wealth building.

By the way: Sign up for my email list to be the first to know when I publish a new blog post!

I recently put together a master list of 88 different ETFs designed to support different investment goals. You can grab it here.

And as always: Buy things that pay you to own them.

-Josh

Blog Post: #120