VOO vs QQQ: Which ETF Is Better?

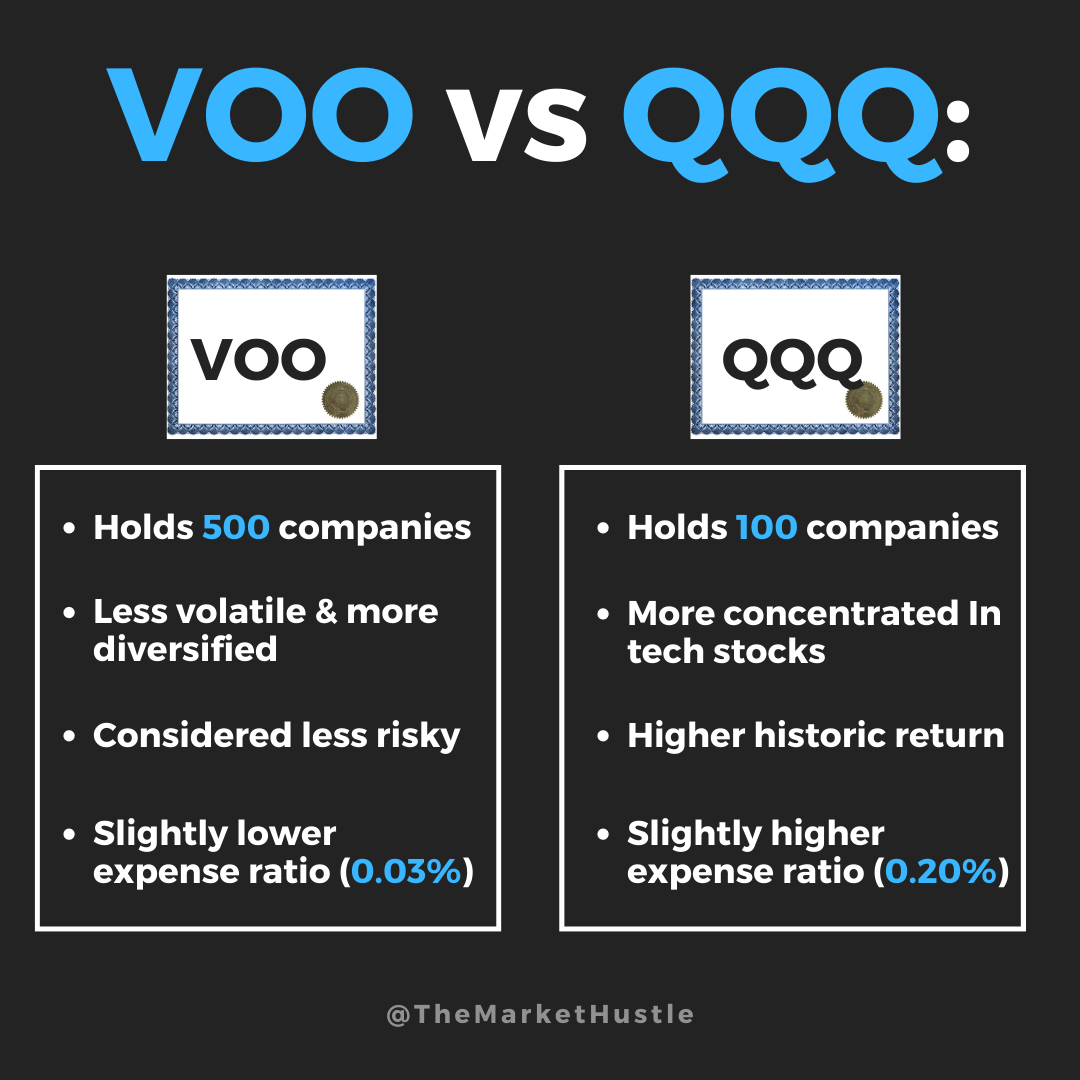

VOO VS QQQ - What’s the difference?

There are a lot of choices when it comes to Exchange Traded Funds (ETFs), and investors can get confused about which ETF is the best for them. In this blog post, we'll compare VOO vs QQQ and help you decide which one is better for your portfolio.

For starters, VOO has 34% of its fund invested in technology stocks, while QQQ has 64% of its fund invested in technology stocks.

Let’s take a deeper dive into each fund…

What is VOO?

VOO is an ETF that seeks to replicate the returns of the S&P 500 Index.

The S&P 500 holds 500 of the most valuable public companies in the USA. Companies that are both profitable and resilient, and have some of the smartest people in the United States working for them.

If you look below, you’ll see the top 10 holdings in VOO, and how much of the entire fund they make up.

The S&P 500 is commonly used as a gauge to judge how the overall U.S. economy is doing.

So in a way, by investing in an S&P 500 Index Fund, you are essentially investing in the overall U.S. economy.

Although the S&P 500 only includes US-based companies, most of the companies operate in markets all around the world. It’s estimated that S&P 500 companies get roughly 40% of their revenue from outside of the U.S. (Source: Barrons).

Historically, the S&P 500 has returned an average of 10% per year for the past century. It’s also one of Warren Buffett’s favorite Index Funds and where he suggests most investors leave their money.

WHO IS VOO GOOD FOR?

VOO is great for those who are looking to get broad exposure to the most valuable public companies in the U.S.

VOO has a low expense ratio of 0.03% per year, and the index holds stocks in all different sectors. Different companies that have stood the test of time and have proven themselves in times of crisis.

What is QQQ?

QQQ is an ETF that tracks the Nasdaq 100 Index. The fund only invests in non-financial related stocks. It holds 100 companies total in the index.

The Nasdaq 100 is dominated by tech companies.

Apple, Amazon, Microsoft, Facebook, and Google make up over 30% of the index alone. So this fund is a lot more concentrated in tech stocks compared to VOO.

The Nasdaq 100 index is a popular way for investors to determine how the overall tech sector is performing.

If you look below, you’ll see the top 10 holdings in QQQ, and how much of the entire fund they make up.

WHO IS QQQ GOOD FOR?

QQQ is a great fund for those who are wanting to take a more aggressive approach when it comes to investing.

The Nasdaq 100 has historically outperformed the S&P 500 over the past few decades but is much more volatile compared to the S&P 500.

So if you are okay with dealing with more volatility and want to take a more aggressive approach, QQQ would be a solid fund. QQQ has an expense ratio of 0.20%, so still low, but not as low as VOO. But it is a great way to invest more aggressively into tech stocks.

My Thoughts: VOO vs QQQ

If you are wanting to invest more aggressively in a tech concentrated fund and are okay with dealing with the extra volatility, QQQ could be a great fund for you to add.

If you are wanting to invest more conservatively but want exposure to the top 500 public U.S. companies, VOO could be a great fund for you to add.

Additionally, you could do a mixture of both funds if you are looking to have broad exposure to the top 500 public U.S. company AND some concentrated exposure to tech stocks. How much you invest in each depends on how concentrated you want to be in tech-related stocks and invested amongst the top 500 public companies in the S&P 500.

If you want to be more aggressive, I’d lean more towards QQQ. If you want to be more conservative, I’d lean more towards VOO.

I personally invest in both VOO and QQQ. I don’t plan on cashing anything out of my investment accounts for around 30 years, so I have taken a more aggressive investing approach and lean more towards QQQ.

Also, sign up for my email list to be the first to know when I publish a new blog post!

Want to keep learning? Check out some of my other blog posts:

As Always: Buy things that pay you to own them.

-Josh

Blog Post: #011