VOO vs SCHD: Which ETF is Better?

VOO and SCHD are both ETFs that provide exposure to the U.S. stock market, but they have different goals, different holdings, and slightly different costs.

Here’s a comparison of the two ETFs to help you decide which one is right for you.

VOO vs SCHD Historic Performance

When accounting for both dividends and share growth, SCHD has slightly outperformed VOO over the past 10 years. SCHD’s focus on dividend-paying stocks has helped it deliver higher returns than VOO. Especially during the recent bear market we’ve experienced. Where tech companies have been hit especially hard, bringing down VOO with them.

However, it’s important to remember that past performance is no guarantee of future results. Ultimately, assessing your individual investment goals and risk tolerance is essential before deciding which ETF is suitable for you.

Image source: etf.com

VOO - Vanguard 500 Index Fund

Goal: VOO seeks to closely track the S&P 500 index's return by holding the 500 largest public companies in the United States.

Number of companies held: 500

VOO dividend yield: 1.65%

VOO Expense Fee: 0.03%

Pros: The S&P 500 index is one of the most widely watched indexes around the world. It’s commonly used to gauge how the overall U.S. economy is doing.

The S&P 500 has provided an average return of 10.67% annually since 1957.

Cons: The fund is only invested in U.S. Stocks.

Although the S&P 500 only includes US-based companies, most of the companies operate in markets all around the world. It’s estimated that S&P 500 companies get roughly 40% of their revenue from outside of the U.S. (Source: Barrons).

If this concerns you, you may want to add some exposure to international stocks outside of the United States.

Additionally, all of the companies held within this fund are large companies. So no exposure is given to smaller companies.

The Top 10 Stocks Held In $VOO:

Image source: etf.com

SCHD - Schwab U.S. Dividend ETF

Goal: To track the Dow Jones U.S. Dividend 100 Index.

Number of companies held: 100

SCHD dividend yield: 3.29%

SCHD expense ratio: 0.06%

Pros of SCHD:

SCHD holds the 100 companies in the Dow Jones 100 Index. The Fund can serve as a great diversified dividend portfolio. The Dow Jones adds top-performing companies in different industries. So there is not a lot of overlap between industries in this fund.

It also offers a high dividend and decent stock appreciation as a bonus.

Over the past 10 years, this fund has averaged a return of around 13% per year.

Cons of SCHD:

Although this is my favorite dividend-related ETF, it only holds 100 stocks, and they're a particular set of large US dividend payers. Making this fund a bit riskier than other funds.

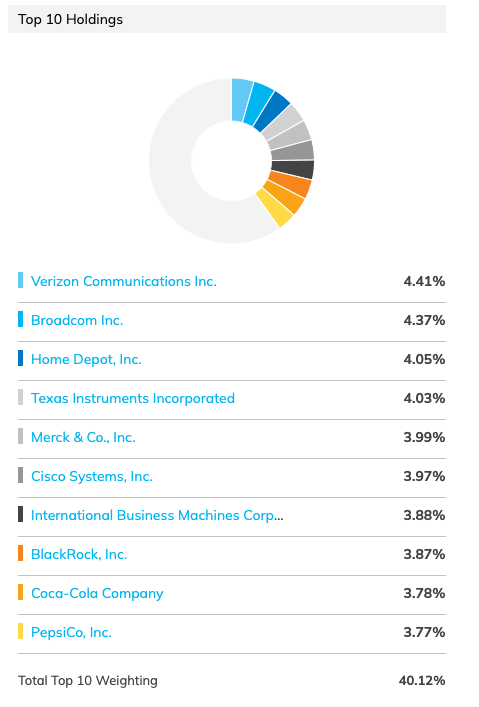

The Top 10 Stocks Held In $SCHD:

Image source: etf.com

My Thoughts: VOO vs SCHD

Both SCHD and VOO are popular ETFs that provide exposure to the U.S. stock market. However, they have different goals and different holdings, so it’s important to compare them carefully before making a decision. SCHD is focused on dividend-paying stocks, while VOO has a broader exposure to the overall U.S. stock market.

If you want to optimize for dividends and share growth, SCHD would be a good choice for you. If you want to optimize for share growth from the overall U.S. stock market, VOO would be a better choice for you.

There may even be room to add exposure to both, depending on how you want to build out your portfolio.

By the way: Sign up for my email list to be the first to know when I publish a new blog post!

I recently put together a master list of 88 different ETFs designed to support different investment goals. You can grab it here.

As Always: Buy things that pay you to own them.

-Josh

Blog Post: #080

Do you have a suggestion on which ETFs I should compare next? Let me know here.