VTI vs QQQ: Which ETF Is Better?

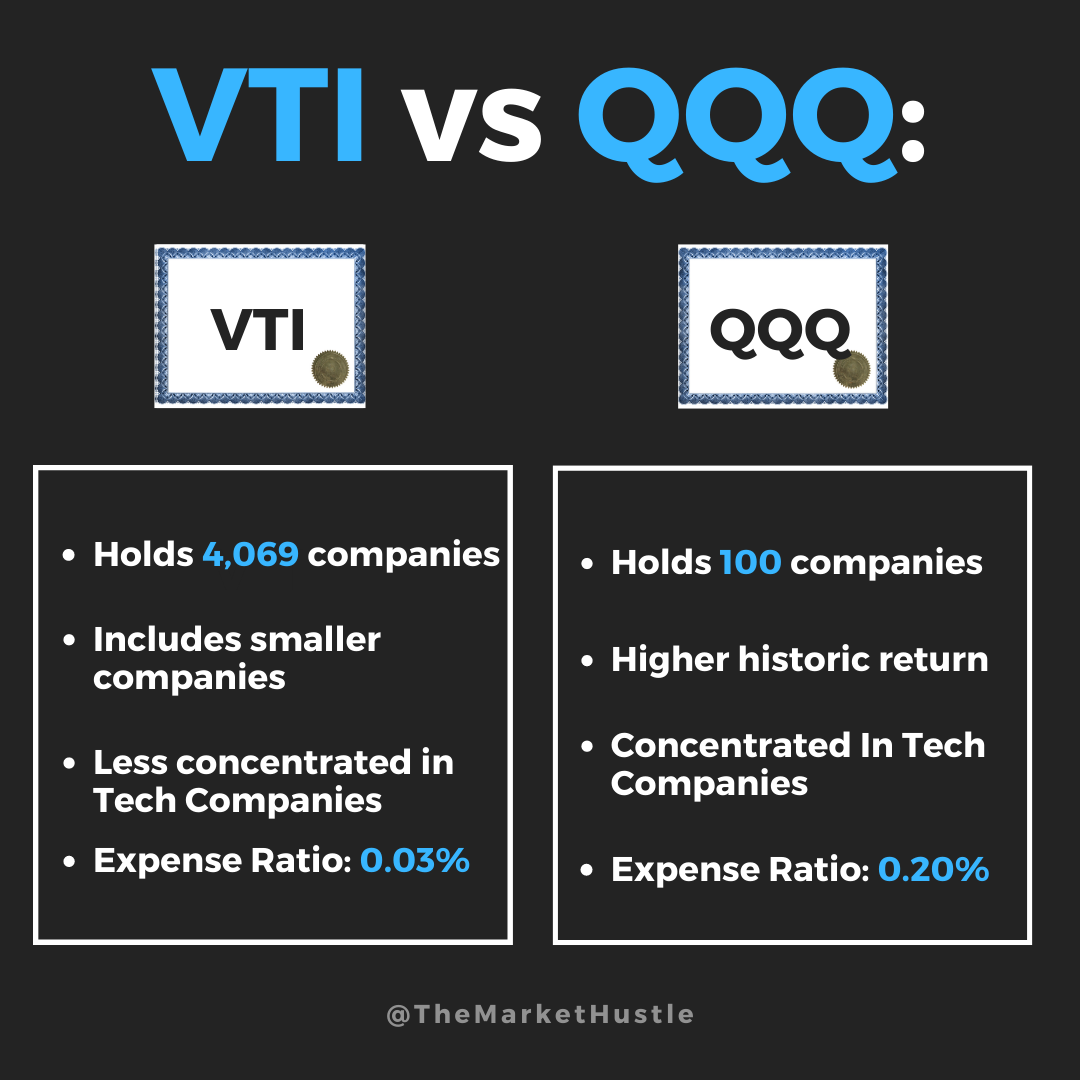

Which ETF is better for you - VTI or QQQ? Both have been popular choices for ETF investors, but which one should you choose?

Let’s compare VTI and QQQ and see which one is better based on what you are looking for.

VTI vs QQQ Historic Performance

Image source: etf.com

QQQ has historically outperformed VTI. This is because QQQ is concentrated in tech stocks. And tech companies have outperformed over the past few decades. The cost of that outperformance is dealing with more volatility. QQQ has historically been much more volatile than VTI.

For example, VTI is currently down around -21% YTD in 2022, while QQQ is down nearly -30%.

VTI - Vanguard Total U.S. Stock Market Fund

Goal: VTI seeks to track the overall U.S. Stock Market's performance, including Mid-Sized and Small-Sized companies.

Number of companies held: 4,069

Annual Expense Fee: 0.03%

Pros: This could be a great fund to add if you’re looking for broad exposure to the U.S. Stock Market.

Cons: Although this fund includes Mid-Sized and Small-Sized companies, the fund is still dominated by large company stocks. This fund might not be a good fit if you want more exposure to smaller companies.

The Top 10 Stocks Held In $VTI:

Image source: etf.com

QQQ - Invesco QQQ Trust

Goal: QQQ tracks a modified-weighted index of 100 NASDAQ-listed stocks.

Number of companies held: 100

Annual Expense Fee: 0.20%

Pros: This fund is excellent for those who want to take a more aggressive approach to investing. QQQ only holds non-financial related stocks. So naturally, QQQ is dominated by tech stocks.

Cons: QQQ is much more volatile compared to VTI. And over 50% of the fund is held in 10 stocks, as seen in the chart below. So if you don’t have the stomach to deal with this fund's additional volatility, you may want to avoid QQQ.

QQQ also has an expense ratio of 0.20%. Still relatively low, but not as low as VTI.

The Top 10 Stocks Held In $QQQ:

Image source: etf.com

My Thoughts: VTI vs QQQ

For starters, VTI has 41% of its fund invested in technology stocks, while QQQ has 65% of its fund invested in technology stocks. So if you want more exposure to aggressive growth tech stocks, QQQ would likely be a better fund.

However, if you want to take more of a conservative investing approach and minimize the volatility of your portfolio, VTI would likely be a better fund for you.

Some investors might even decide to add a mixture of both funds to their portfolio. How much of each fund they add depends on how aggressive they want to be.

If you want to be more aggressive, I’d lean more toward QQQ. If you want to be more conservative, I’d lean more toward VOO.

By the way: Sign up for my email list to be the first to know when I publish a new blog post!

I recently put together a master list of 88 different ETFs designed to support different investment goals. You can grab it here.

-Josh

Blog Post: #062

Do you have a suggestion on which ETFs I should compare next? Let me know here.