BOTZ vs QQQ: Which ETF Is Better?!

Both BOTZ and QQQ offer investors a unique opportunity to invest in the technology sector, but with a different twist. BOTZ focuses on the world of robotics and artificial intelligence, while QQQ targets the top companies in the NASDAQ.

Which one is the better choice for your investment needs? Keep reading to find out!

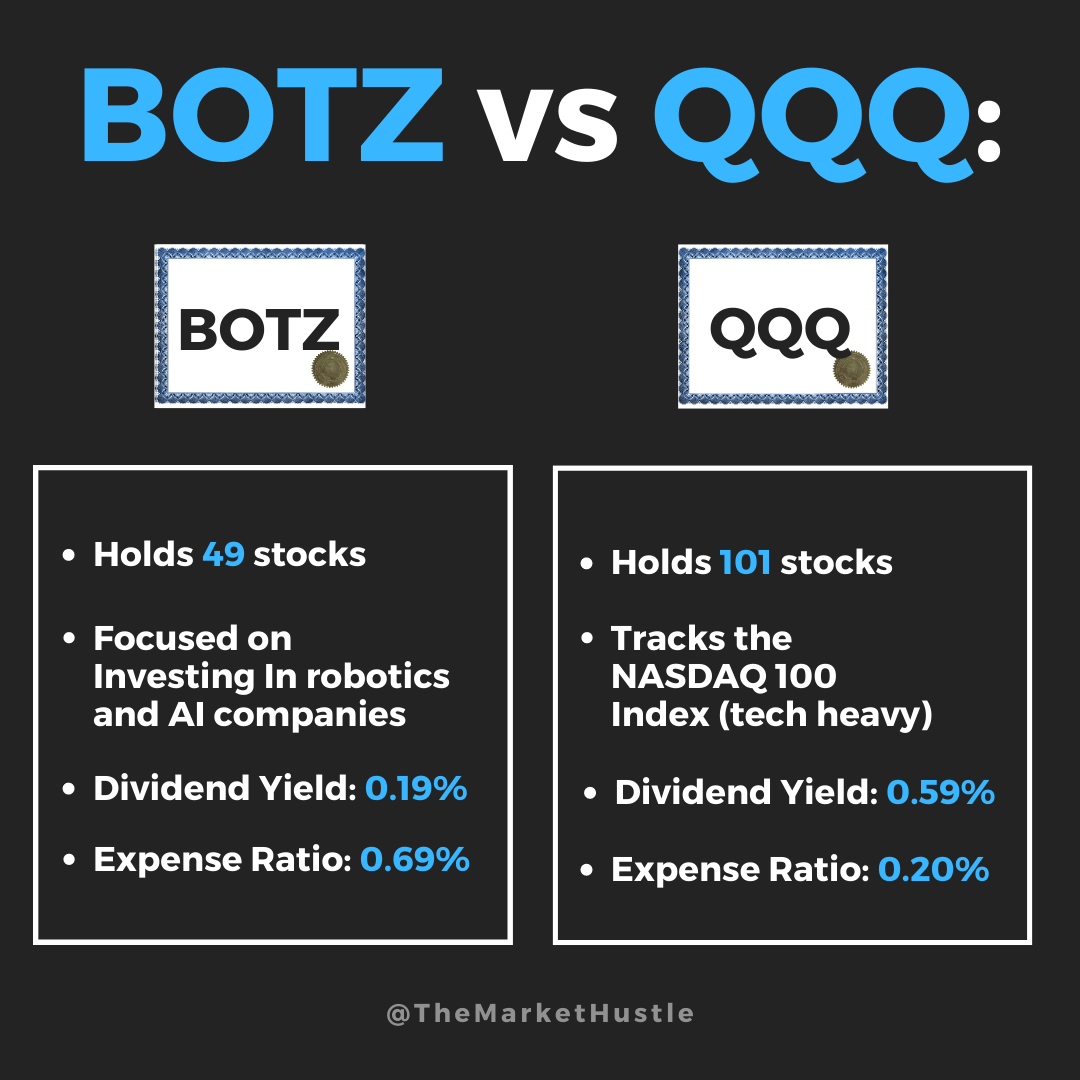

BOTZ - Global X Robotics & Artificial Intelligence ETF

Goal: BOTZ aims to provide investors with exposure to companies involved in the development and application of robotics and artificial intelligence technology.

Number of Stocks held: 49

Dividend Yield: 0.19%

Annual Expense Fee: 0.69%

Benefits of BOTZ: BOTZ offers investors access to a niche sector with significant growth potential, as robotics and artificial intelligence are expected to play a crucial role in the future of various industries. This fund allows investors to gain exposure to this exciting area without having to bet on specific stocks in a risky and turbulent industry.

Downsides of BOTZ: The main downside of BOTZ is its narrow focus on robotics and AI. As a result, the fund may be more volatile and susceptible to fluctuations within this specific industry. Additionally, the expense ratio of 0.68% is relatively high compared to broader market ETFs.

The Top 10 Stocks Held In $BOTZ:

Image source: ETF.com

QQQ - Invesco QQQ Trust

Goal: QQQ aims to track the performance of the NASDAQ-100 Index, which includes 100 of the largest non-financial companies listed on the NASDAQ Stock Market.

Number of Stocks held: 101

Dividend Yield: 0.59%

Annual Expense Fee: 0.20%.

Benefits of QQQ: QQQ offers investors broad exposure to the technology sector, including industry giants like Apple, Microsoft, and Amazon. This ETF is known for its strong historical performance and lower volatility compared to individual technology stocks. Additionally, the expense ratio of 0.20% is relatively low, making it a cost-effective investment.

Downsides of QQQ: While QQQ offers a more diversified approach to the technology sector, it is still heavily weighted in a few top companies. This concentration may expose investors to potential risks associated with these specific stocks.

The Top 10 Stocks Held In $QQQ:

Image source: ETF.com

Final Thoughts: BOTZ vs QQQ

Both BOTZ and QQQ can be suitable choices for investors looking to gain exposure to the technology sector.

If you're interested in a niche investment focusing on robotics and artificial intelligence, BOTZ may be the better option. However, if you prefer a more diversified approach to the technology industry, QQQ is likely the more appropriate choice.

By the way: Sign up for my email list to be the first to know when I publish a new blog post!

I recently put together a master list of 88 different ETFs designed to support different investment goals. You can grab it here.

And as always: Buy things that pay you to own them.

-Josh

Blog Post: #095