VOO vs FXAIX - Which S&P 500 Fund Is Better?

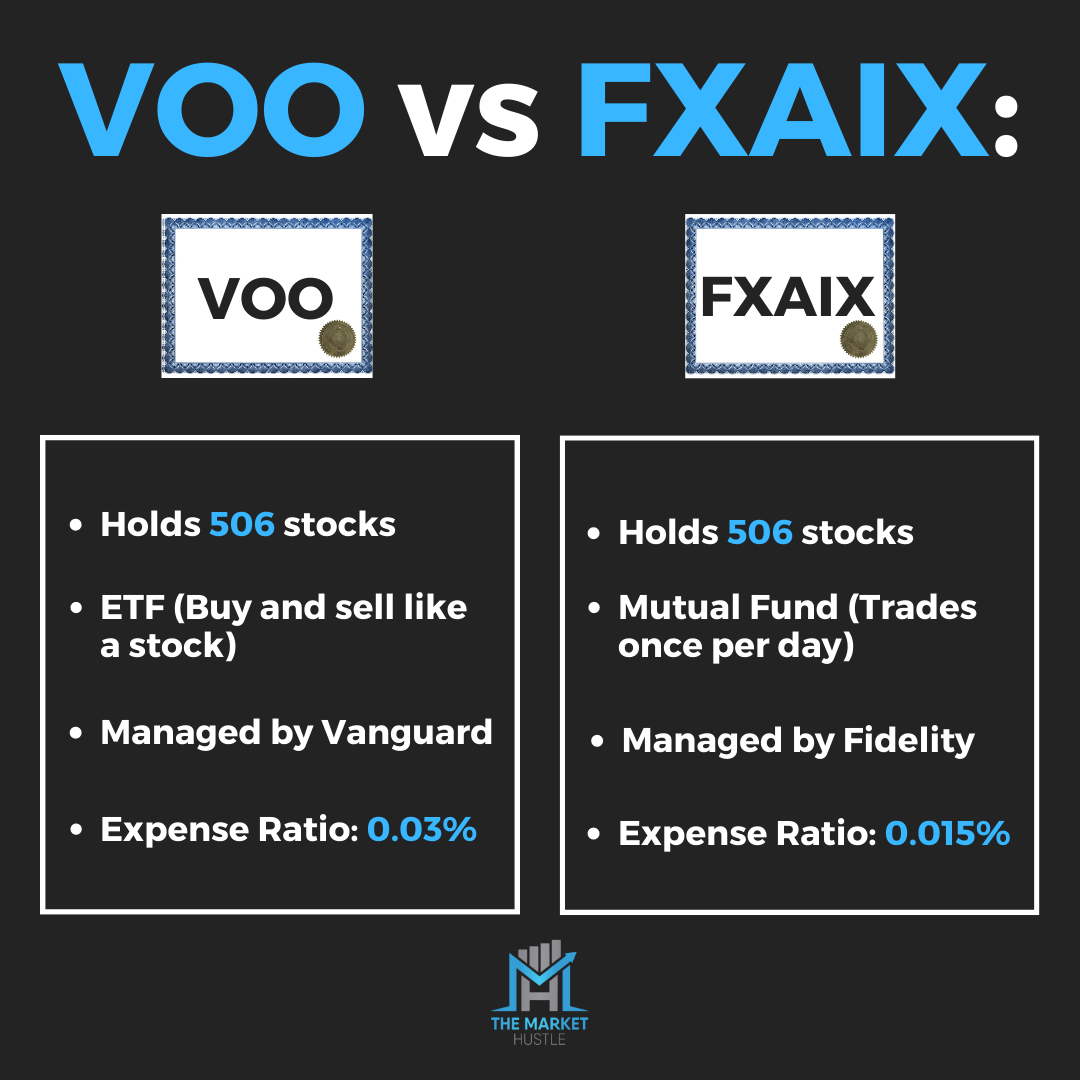

Both VOO and FXAIX are popular choices for investors looking to build long-term wealth through exposure to the stock market. The main difference? VOO is an ETF, while FXAIX is a mutual fund.

But don't worry, we'll explore this difference in more detail as we dive in.

So, buckle up as we compare these two investment options to help you decide which one is right for you!

VOO - Vanguard S&P 500 (ETF)

Goal: VOO aims to track the performance of the S&P 500 Index, which includes 500 of the largest U.S. companies.

Number of Stocks held: 506

Dividend Yield: 1.53%

Annual Expense Fee: 0.03%.

Benefits of VOO: VOO is an ETF that offers investors exposure to a broad range of U.S. companies, giving investors a diversified portfolio. The low expense ratio makes it an affordable choice for investors, and it's known for its liquidity, which means buying and selling shares is usually easy.

Downsides of VOO: The fund is only invested in U.S. Stocks. Although the S&P 500 only includes US-based companies, most of the companies operate in markets all around the world. It’s estimated that S&P 500 companies get roughly 40% of their revenue from outside of the U.S. (Source: Barrons).

If this concerns you, you may want to add some exposure to international stocks outside of the United States.

ETFs explained: ETFs can be bought and sold on stock exchanges during the day, like regular stocks. This makes them more flexible and easy to trade compared to mutual funds, which have their prices set only once a day after the market closes. Also, ETFs usually cost less in fees and can be more tax-efficient.

FXAIX - Fidelity 500 Index Fund

Goal: FXAIX aims to replicate the performance of the S&P 500 Index, just like VOO.

Number of Stocks held: 506

Dividend Yield: 1.49%

Annual Expense Fee: 0.015%.

Benefits of FXAIX: As a mutual fund, FXAIX offers investors a convenient way to invest in a diversified portfolio of large U.S. companies. The extremely low expense ratio makes it an attractive option for cost-conscious investors. Unlike ETFs, mutual funds are bought and sold at the end of the day, which can make it easier for investors to stick to a long-term strategy.

Downsides of FXAIX: One downside of FXAIX is that while ETFs can be bought and sold throughout the day, mutual funds like FXAIX are priced and traded only once daily which could be a disadvantage for investors who value flexibility.

Mutual Funds explained: A mutual fund is a type of investment where money from many investors is pooled together to buy a mix of stocks, bonds, or other assets. The value of a mutual fund changes daily based on the performance of the assets it holds. Mutual funds typically require a minimum initial investment, making it necessary for investors to commit a certain amount of money to get started.

Final Thoughts: VOO vs FXAIX

Both VOO and FXAIX are excellent options for investors seeking exposure to the S&P 500 Index.

Your choice between these two options will largely depend on your preference for an ETF or a mutual fund. VOO offers easy daily trading and liquidity, while FXAIX may appeal to long-term investors who appreciate the end-of-day pricing structure.

Both options have low expense ratios, making them cost-effective choices for investors looking to build long-term wealth.

No matter which one you choose, you'll gain access to a diversified portfolio of large U.S. companies to help grow your investment over time.

By the way: Sign up for my email list to be the first to know when I publish a new blog post!

I recently put together a master list of 88 different ETFs designed to support different investment goals. You can grab it here.

And as always: Buy things that pay you to own them.

-Josh

Blog Post: #106