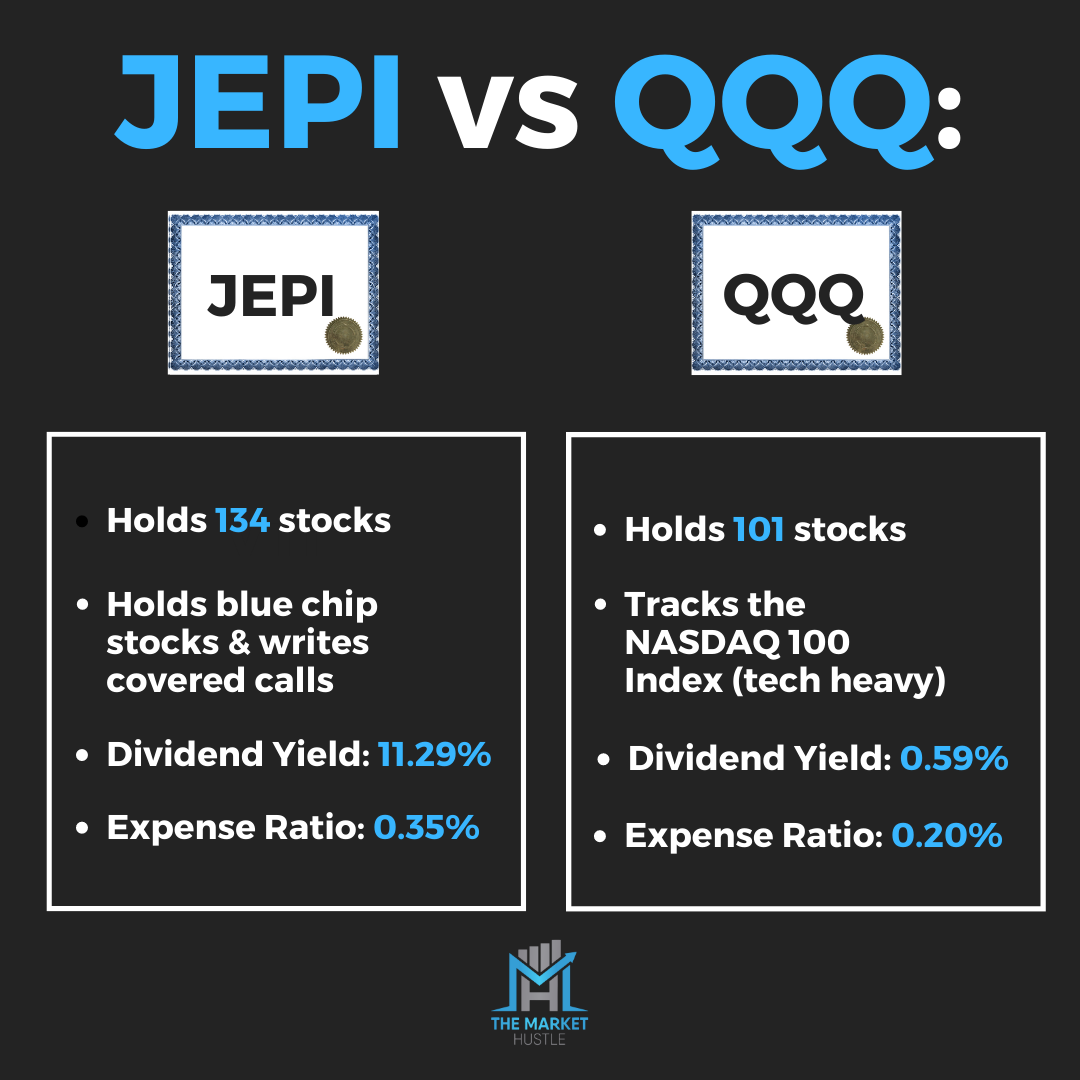

JEPI vs QQQ - Which ETF Is Better?

Both JEPI and QQQ offer investors an opportunity to access the world of stocks without the hassle of picking individual companies.

JEPI aims to provide consistent income through a combination of blue-chip stocks and covered call contracts, while QQQ tracks the NASDAQ-100 Index, giving investors exposure to the largest non-financial companies in the U.S.

So, which ETF should you choose?

Let's dive deeper into their unique features and find out.

JEPI - J.P. Morgan Equity Premium Income ETF

Goal: Makes money by selling options and investing in large blue-chip U.S. stocks to get monthly income from option premiums and stock dividends. The fund seeks to offer a consistent income stream with lower volatility than the S&P 500. It is ideal for retirees or those ready to live off their investments.

Number of companies held: 128

Dividend Yield: 11.29%

Annual Expense Fee: 0.35%

Benefits of JEPI: One of the unique benefits of JEPI is its attractive dividend yield, which means investors can receive a relatively high income compared to other funds. Additionally, this fund has a monthly distribution schedule, making it ideal for those who want a more frequent income stream.

JEPI is structured to deliver a 5% to 8% dividend yield over time, and 6% to 10% annual returns. The fund does this by using covered calls, meaning it writes options against an underlying portfolio of stocks in the fund to generate extra income.

Downsides of JEPI: The downsides of JEPI include its relatively high expense ratio compared to other income-focused ETFs. Also, since it focuses on income generation, it may not provide the same level of capital appreciation that some investors might be looking for.

Beating the stock market isn't the goal of this fund, and JEPI fund managers make it clear that investors shouldn't expect the high dividend yield to continue. Covered call ETFs generally perform best in volatile bear markets.

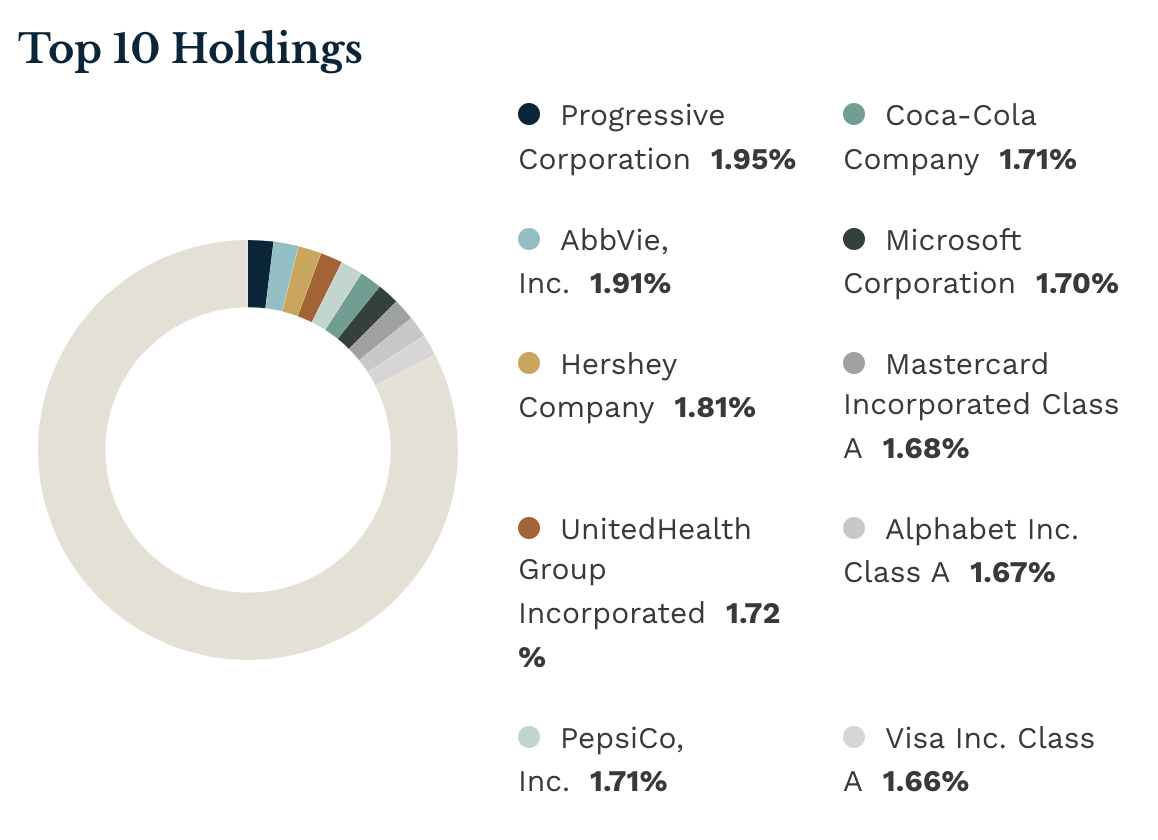

The Top 10 Stocks Held In $JEPI:

Image source: ETF.com

QQQ - Invesco QQQ Trust

Goal: The goal of the QQQ fund is to provide investors with investment results that correspond to the performance of the NASDAQ-100 Index, which includes 100 of the largest non-financial companies listed on the NASDAQ Stock Market.

Number of Stocks held: 101

Dividend Yield: 0.59%

Annual Expense Fee: 0.20%

Benefits of QQQ: QQQ has a long track record and is a popular choice for investors seeking exposure to large technology and innovative companies. It offers a cost-effective way to invest in some of the world's most well-known and successful businesses. Additionally, QQQ has a history of strong performance and is highly liquid, making it easy for investors to buy and sell shares.

Downsides of QQQ: The primary downside of QQQ is its heavy concentration in the technology industry, which can make it more volatile and susceptible to higher risks. QQQ's focus on large companies means it may miss out on the growth potential of smaller, emerging companies.

The Top 10 Stocks Held In $QQQ:

Image source: etf.com

Final Thoughts: JEPI vs QQQ

Both JEPI and QQQ can be great additions to your investment portfolio, depending on your financial goals and risk tolerance.

If you prioritize dividend income and want to minimize volatility, JEPI could be a better fit. However, it's worth noting that since the beginning of 2023 (year-to-date), JEPI has returned 4.31%, while QQQ has returned a more impressive 21.18% when considering both share growth and dividends.

If you're looking for growth and exposure to some of the most innovative companies in the United States, QQQ might be a better choice for you.

Remember, it's essential to carefully consider your individual financial situation and investment goals before making any decisions.

By the way: Sign up for my email list to be the first to know when I publish a new blog post!

I recently put together a master list of 88 different ETFs designed to support different investment goals. You can grab it here.

And as always: Buy things that pay you to own them.

-Josh

Blog Post: #105