VOO VS SPY - Which S&P 500 ETF Is Better?

Both VOO and SPY are designed to track the performance of the S&P 500 index, making them popular choices for investors looking to gain exposure to the U.S. stock market.

While both funds have similar objectives, they each have their unique features that might make one a better fit for your investment goals.

Although it's impossible to keep two Index ETFs completely identical from a statistical standpoint, the differences that arise are generally insignificant and quickly resolved. These differences are often arbitrary and don't hold much meaning over the long run.

So, which one should you choose? Let's dive in!

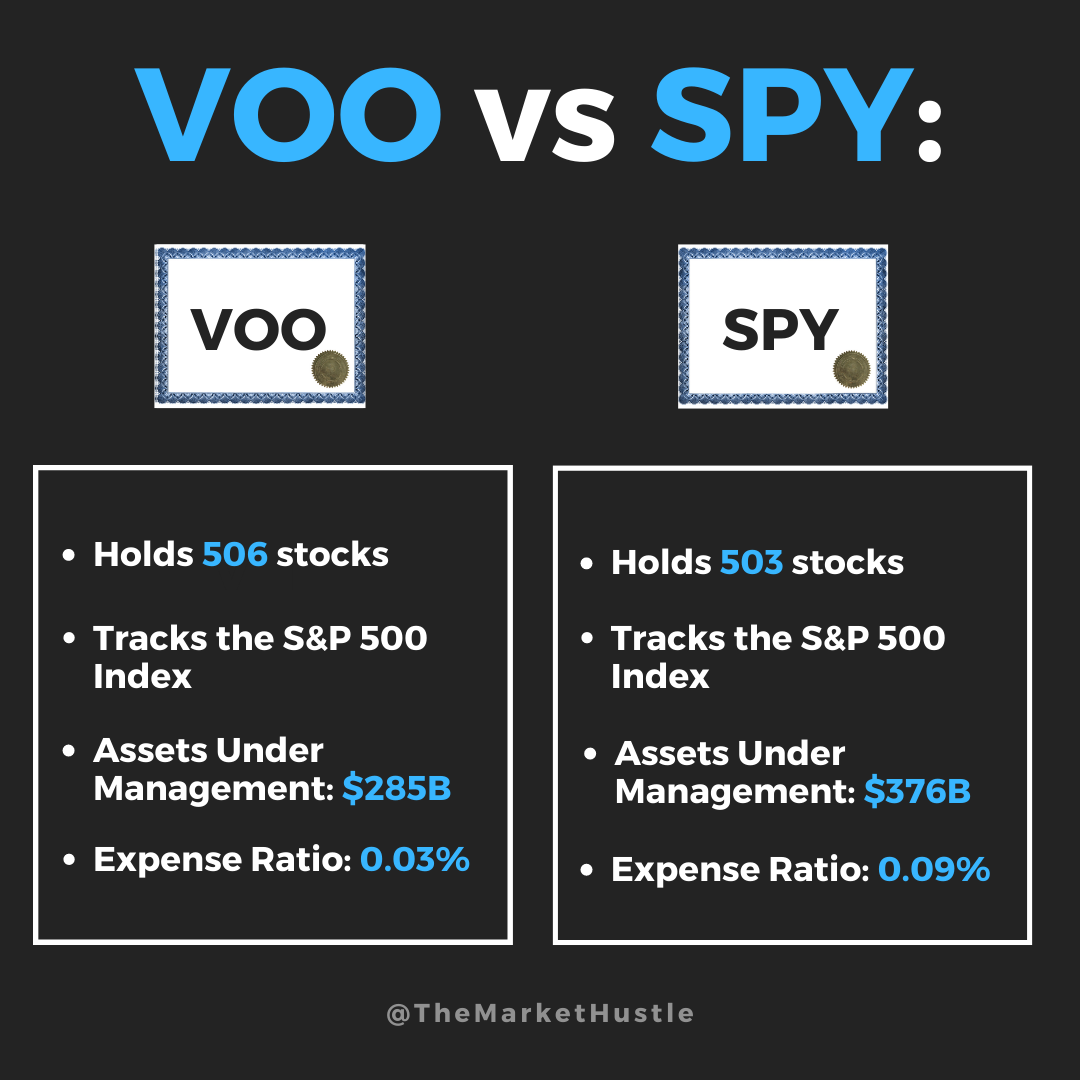

VOO - Vanguard S&P 500 ETF

Goal: VOO is managed by Vanguard and aims to closely track the performance of the S&P 500 index, which consists of 500 leading U.S. companies representing various sectors of the economy.

Number of Stocks held: 506

Dividend Yield: 1.57%

Annual Expense Fee: 0.03%

Benefits of VOO: VOO is known for its low expense ratio, making it a cost-effective choice for investors who want to track the S&P 500 index. Additionally, as a Vanguard fund, VOO has a reputation for being reliable and well-managed. Its diversified holdings across various sectors can help reduce risk for investors seeking broad U.S. market exposure.

Downsides of VOO: While there are few downsides to VOO, it may not be the best choice for investors seeking a more aggressive or niche investment strategy, as it is designed to track the overall U.S. stock market.

The Top 10 Stocks Held In $VOO:

Image source: ETF.com

SPY - SPDR S&P 500 ETF Trust

Goal: Just like VOO, SPY’s goal is to replicate the performance of the S&P 500 index, giving investors exposure to the 500 largest U.S. companies spanning multiple industries.

Number of Stocks held: 503

Dividend Yield: 1.73%

Annual Expense Fee: 0.09%

Benefits of SPY: SPY is the oldest and most well-known ETF tracking the S&P 500 index, making it a trusted option for many investors. Additionally, SPY is known for its high liquidity, which can be beneficial for investors who trade more frequently.

Downsides of SPY: The main downside of SPY is its slightly higher expense ratio compared to VOO. This difference isn’t significant but can still add up a bit over time, especially for long-term investors.

The Top 10 Stocks Held In $SPY:

Image source: ETF.com

Final Thoughts: VOO vs SPY

Both VOO and SPY are outstanding choices for investors seeking to gain exposure to the U.S. stock market through the S&P 500 index.

Personally, I am a fan of VOO due to its lower expense ratio, which may be more appealing to cost-conscious investors.

On the other hand, SPY might be more suitable for those who prioritize liquidity or want to invest in a fund with a longer track record.

It is essential to note that you don't need both of these funds in your portfolio, as they track the exact same index and will yield identical returns over the long run.

Ultimately, the choice between these two funds will depend on your individual investment goals and preferences.

By the way: Sign up for my email list to be the first to know when I publish a new blog post!

I recently put together a master list of 88 different ETFs designed to support different investment goals. You can grab it here.

And as always: Buy things that pay you to own them.

-Josh

Blog Post: #102