QQQ vs QQQJ - Which ETF Is Better?

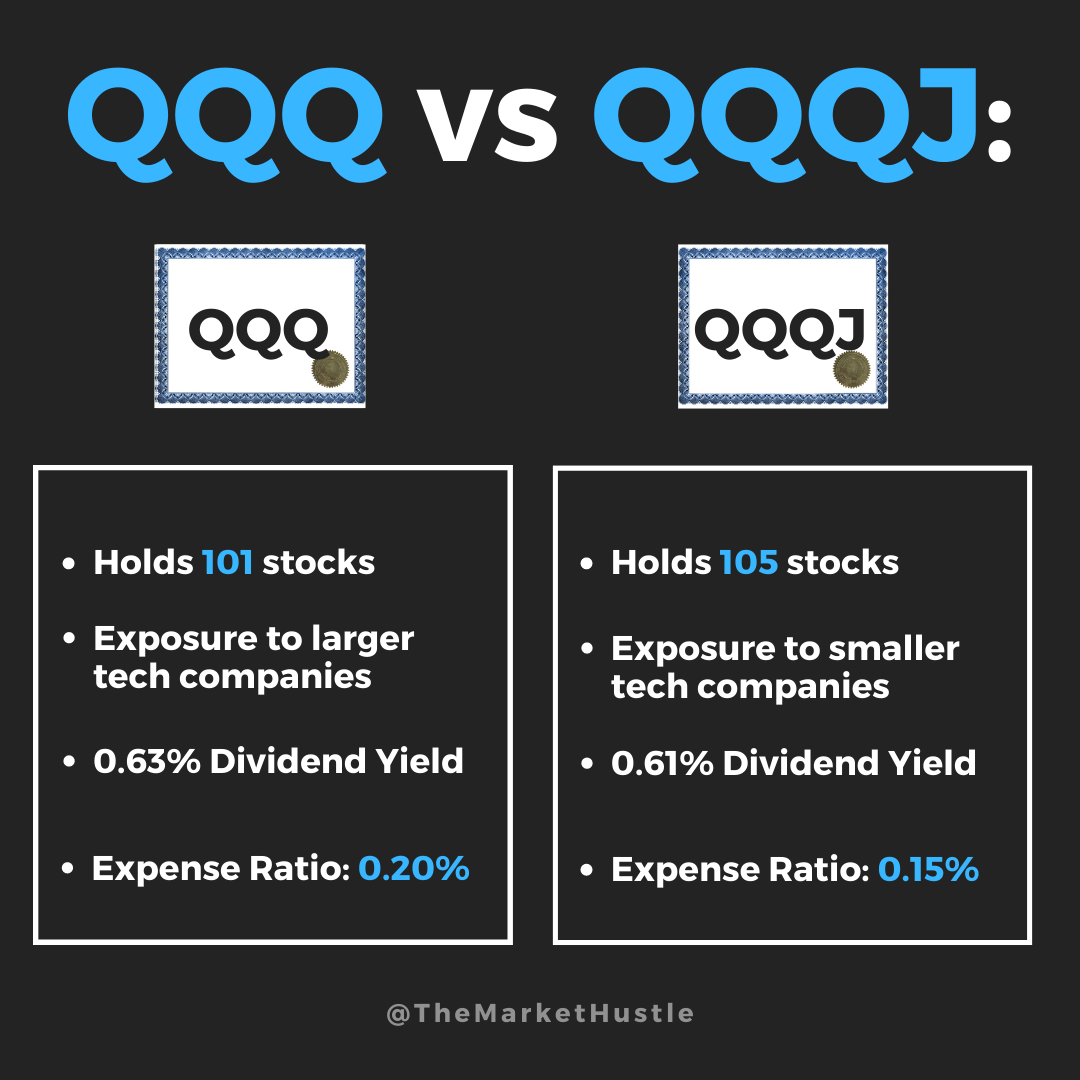

Both QQQ and QQQJ offer investors exposure to different segments of the technology-heavy NASDAQ stock exchange.

QQQ focuses on the largest and most established companies, while QQQJ targets smaller, up-and-coming businesses with more potential for growth.

Which of these ETFs should you choose for your investment portfolio?

Keep reading to find out!

QQQ - Invesco QQQ Trust

Goal: The goal of the QQQ fund is to provide investors with investment results that correspond to the performance of the NASDAQ-100 Index, which includes 100 of the largest non-financial companies listed on the NASDAQ Stock Market.

Number of Stocks held: 101

Dividend Yield: 0.63%

Annual Expense Fee: 0.20%

Benefits of QQQ: QQQ has a long track record and is a popular choice for investors seeking exposure to large technology and innovative companies. It offers a cost-effective way to invest in some of the world's most well-known and successful businesses. Additionally, QQQ has a history of strong performance and is highly liquid, making it easy for investors to buy and sell shares.

Downsides of QQQ: The primary downside of QQQ is its heavy concentration in the technology industry, which can make it more volatile and susceptible to higher risks. QQQ's focus on large companies means it may miss out on the growth potential of smaller, emerging companies.

The Top 10 Stocks Held In $QQQ:

Image source: etf.com

QQQJ - Invesco NASDAQ Next Gen 100 ETF

Goal: The goal of the QQQJ fund is to provide investment results that correspond to the performance of the NASDAQ Next Generation 100 Index. This index includes the next 100 non-financial companies in line for inclusion in the NASDAQ-100 Index, based on market capitalization.

Number of Stocks held: 105

Dividend Yield: 0.61%

Annual Expense Fee: 0.15%

Benefits of QQQJ: QQQJ offers a unique opportunity to invest in smaller, high-growth companies that could become tomorrow's market leaders. This ETF provides exposure to a more diverse range of sectors compared to QQQ, potentially reducing the risk of being overly concentrated in a single industry. Additionally, QQQJ has a slightly lower expense ratio than QQQ.

Downsides of QQQJ: The main downside of QQQJ is the higher risk associated with investing in smaller, less-established companies. These businesses may be more vulnerable to market fluctuations and have less predictable revenue streams (and resources) than their larger counterparts.

The Top 10 Stocks Held In $QQQJ:

Image source: etf.com

Final Thoughts: QQQ vs QQQJ

QQQ offers exposure to well-established large companies, making it a good choice for those seeking stability and a history of strong performance.

On the other hand, QQQJ provides access to smaller, high-growth companies with the potential for significant gains, making it more suitable for investors who are willing to accept higher risk for potentially greater returns.

Both QQQ and QQQJ can be suitable additions to an investment portfolio, depending on your goals and risk tolerance. It's important to note that QQQJ is a newer fund, so it doesn't have as much historical performance data to analyze.

However, since the beginning of 2023, QQQ is up 17.30%, while QQQJ is up only 1.62%. QQQJ has been hit harder during the market crash we've been experiencing due to the volatile nature of the companies it holds. During intense bull markets, the results could be reversed.

By the way: Sign up for my email list to be the first to know when I publish a new blog post!

I recently put together a master list of 88 different ETFs designed to support different investment goals. You can grab it here.

And as always: Buy things that pay you to own them.

-Josh

Blog Post: #103