Is JEPI a Good Investment? (Immediate Cash Flow VS Long-term Growth)

JEPI can be a solid investment for those in search of immediate, consistent cash flow, particularly in bear markets. It is ideal for retirees or those ready to live off their investments. However, for those with a longer investment horizon and no immediate income requirements, an index fund, with its potential to outpace JEPI in the long run, might be a more fitting choice.

Is Dividend Investing the Best Strategy for Retirement? (Compaing VOO & SCHD)

Whether VOO or SCHD is a better choice depends on your individual circumstances and goals. If you have a longer time horizon, can tolerate more share volatility, and are more interested in growth, VOO might be the better choice. However, if you value stability and need regular income, or are closer to retirement, SCHD may be the better fit.

How Apple Makes Money from Apple Credit Card and Apple Savings

Apple has proven itself as not just a tech giant, but also a major player in the financial industry through its Apple Credit Card and Apple Savings offerings. By monetizing these services in various ways, such as fees from Goldman Sachs, interest from deposits, and data collection, they have demonstrated their commitment to creating innovative and useful financial products for their customers.

Understanding and Overcoming New Investor Pitfalls

By recognizing the emotional traps, understanding the risk and volatility, diversifying investments, focusing on long-term goals, having a clear plan, and exercising caution with leveraging, new investors can navigate bear markets and recessions more effectively.

The Average Household's Lifetime Tax Bill: $3.6 Million

According to recent estimates, the average American household will pay an astounding $3.6 million in taxes over their lifetime. This figure includes federal, state, and local taxes. That's a significant part of any family's lifetime earnings.

From Penny Stocks to Powerhouses

A large company can still have plenty of room to grow, just as a small company might be on the brink of bankruptcy. Investing isn't about finding the next Apple or Facebook, it's about understanding the market, the companies, and their potential.

Striking the Balance: Overcoming Over-Frugality

Yes, it's crucial to save, invest, and think about the future. But it's equally important to live in the present and enjoy the journey. After all, isn't that what all the hard work is for?

SCHG vs QQQ - Which ETF is Better?

SCHG, with its focus on large-cap growth stocks, is suitable for investors looking for broad exposure to potentially high-growth U.S. companies. On the other hand, QQQ, with its focus on the tech-heavy NASDAQ-100, could be a good fit for those wanting concentrated exposure to the growth of technology.

VWO vs VT: Which Global ETF Is Better?

Both VWO and VT could be great additions to your portfolio if you're interested in global investing. The big difference between the two is that VWO focuses exclusively on emerging markets, while VT includes stocks from both emerging and developed markets.

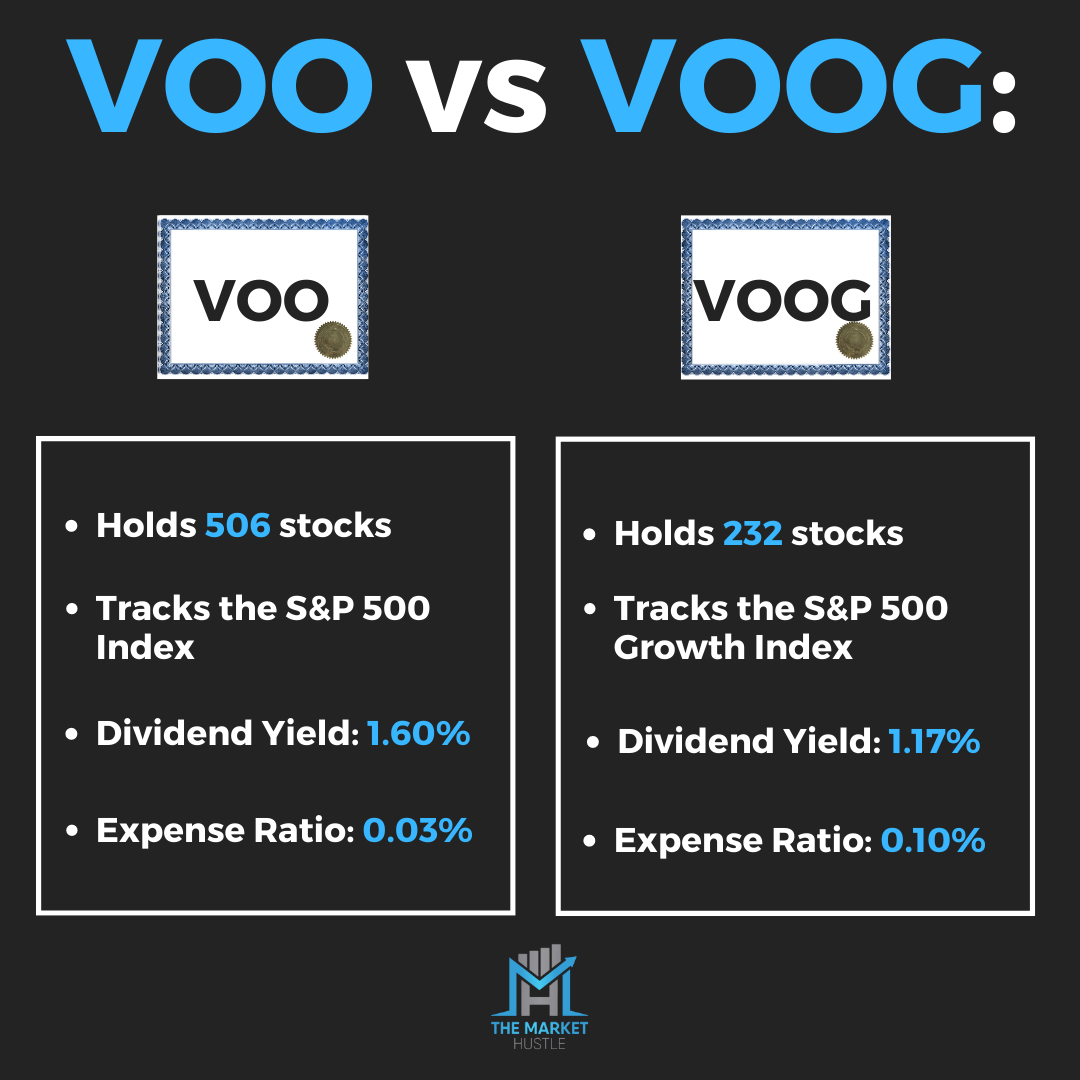

VOO vs VOOG: Which ETF Is Better?

VOO and VOOG are both strong options for investors looking to invest in large U.S. companies. VOO offers a more diverse range of companies and a slightly higher dividend yield, while VOOG specifically targets growth stocks and may provide higher returns during periods when growth stocks are outperforming.

The Millionaire Mindset: Spending vs. Investing

The key to becoming a true millionaire is not just to spend a million dollars but to build a sustainable source of income through smart investments and financial discipline. By focusing on money management skills and recognizing the impact of consumer culture on our financial choices, we can break free from the cycle of impulse spending and create lasting wealth.

The Cheat Code to Early Retirement: Combining a 9-5 Job + Side Hustle

Having a 9-5 job and a side hustle is an effective cheat code to retiring early, as it allows you to invest extra money, grow your wealth, and diversify your income streams.

VOO vs FXAIX - Which S&P 500 Fund Is Better?

Both VOO and FXAIX are excellent options for investors seeking exposure to the S&P 500 Index. Your choice between these two options will largely depend on your preference for an ETF or a mutual fund. VOO offers easy daily trading and liquidity, while FXAIX may appeal to long-term investors who appreciate the end-of-day pricing structure.

JEPI vs QQQ - Which ETF Is Better?

If you prioritize dividend income and want to minimize volatility, JEPI could be a better fit. However, it's worth noting that since the beginning of 2023 (year-to-date), JEPI has returned 4.31%, while QQQ has returned a more impressive 21.18% when considering both share growth and dividends.

VDE vs XLE - Which Energy ETF Is Better?

VDE provides a more diversified portfolio with a lower expense ratio, making it suitable for cost-conscious investors who want broader exposure to the energy sector. On the other hand, XLE offers a higher dividend yield and focuses on larger, more established companies, making it a potential choice for income-seeking investors who prefer stability.

QQQ vs QQQJ - Which ETF Is Better?

QQQ offers exposure to well-established large companies, making it a good choice for those seeking stability and a history of strong performance. On the other hand, QQQJ provides access to smaller, high-growth companies with the potential for significant gains, making it more suitable for investors who are willing to accept higher risk for potentially greater returns.

VOO VS SPY - Which S&P 500 ETF Is Better?

Both VOO and SPY are excellent choices for investors looking to gain exposure to the U.S. stock market through the S&P 500 index. VOO may be more appealing to cost-conscious investors due to its lower expense ratio, while SPY might be a better fit for those who prioritize liquidity or a fund with a longer track record.

VUG vs QQQ - Which Tech Focused ETF Is Better?

So far this year, VUG has seen a 14.26% return, while QQQ has had a slightly higher return of 16.59% since the beginning of 2023. Looking back over the past ten years, VUG hasn't quite kept up with QQQ, delivering an annualized return of 13.26% compared to QQQ's more impressive 17.16% annualized return.

The Secrets of Millionaires: How to Build Multiple Streams of Income

Building multiple streams of income is not an overnight process. It requires dedication, hard work, and a willingness to learn and grow. By investing in yourself, monetizing your passions, networking, accumulating income-generating assets, and leveraging your time, you can create a diversified income portfolio that sets you on the path to financial success.

Navigating the Hidden Job Market: 80% of Job Opportunities Are Never Made Public

By focusing on networking and developing relationships with people in a field you desire to enter, you can tap into a wealth of opportunities hidden from most job seekers. Though public job postings may seem like the most straightforward path, but they represent only a fraction of the available opportunities.